The Truth About Battery Costs

Batteries for commercial EVs (vans, trucks and buses) are more expensive than you might think. Here’s why…

Commercial EVs require high quality battery cells, fully packaged with sophisticated battery management systems and thermal management accessories (hoses, cooling pumps, etc.). These components are both supply-constrained and expensive, with low-volume pricing today typically exceeding $600/kWh. This is a surprise to many fleets forecasting and waiting for cheaper commercial vehicles because they have seen reports from McKinsey and the U.S. Department of Energy. McKinsey recently published a document saying that EV batteries have dropped to $227/kWh, and they see $100/kWh as the target for true price parity with ICE vehicles. The DOE recently published a report showing a $200/kWh price point today for EV batteries.

Reports don’t always tell the whole story.

There are four problems with relying heavily on these sources:

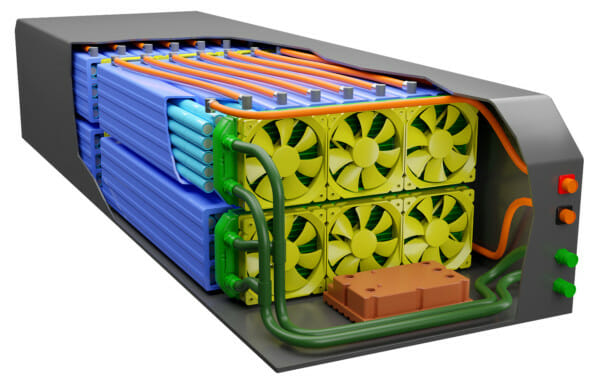

- These reports are focused on passenger vehicles, not commercial vehicles. A typical electric commercial vehicle will have between 2 and 10 times the amount of batteries as a typical passenger EV, so the systems, components, thermal management, power density requirements, power requirements, charging requirements, and geometric requirements are all different from a passenger EV.

- Cell quality is not considered in these reports. There remain reliability and MTBF differences of up to 10X between various cell manufacturers (i.e. some cells are failing after only one year on the road, others have reportedly survived for ten years on the road). The difference in price between a cheap cell and an expensive cell today is about 35%, so a $227/kWh battery with cheap cells can quickly become a $300/kWh battery if equipped with high-reliability cells.

- Another problem is that the studies do not differentiate on volume purchase sizes. EV commercial vehicles today sell at a fraction of the volumes of EV passenger vehicles, and since the packs are not the same between the commercial vehicles and passenger vehicles, commercial EV manufacturers cannot expect the large discounts that come with large-volume battery orders. This volume factor alone represents a 50% increase in pricing, so a $300/kWh battery quickly becomes a $450/kWh battery.

- Finally, the full manufacturing, shipping and tariff costs, as well as ancillary items like thermal management systems are not taken into account. Careful battery thermal management (heating and cooling tolerances within 4°C) is essential for commercial EV battery longevity and efficiency — and the costs of this in a commercial EV add about 35% to the overall battery system cost. A $450/kWh battery quickly rises to $600 kWh.

Context is everything

The primary challenge with comparing data in these reports is the lack of context: a cheap cell with no thermal management, that will likely fail within the first two years, bought in an order quantity for 1,000 vehicles, is considered in the same pricing bucket with a thermally-managed, high-quality cell bought for an order of 20 vehicles.

The bottom line is that commercial electric vehicles with high-quality battery systems will continue to cost more than a comparable ICE vehicle for some time into the future. As more customers experience the on-road failures of the cheap battery systems, the value of the high-quality systems will become more apparent.