The Truth About Reliability

Electric Commercial Vehicles:

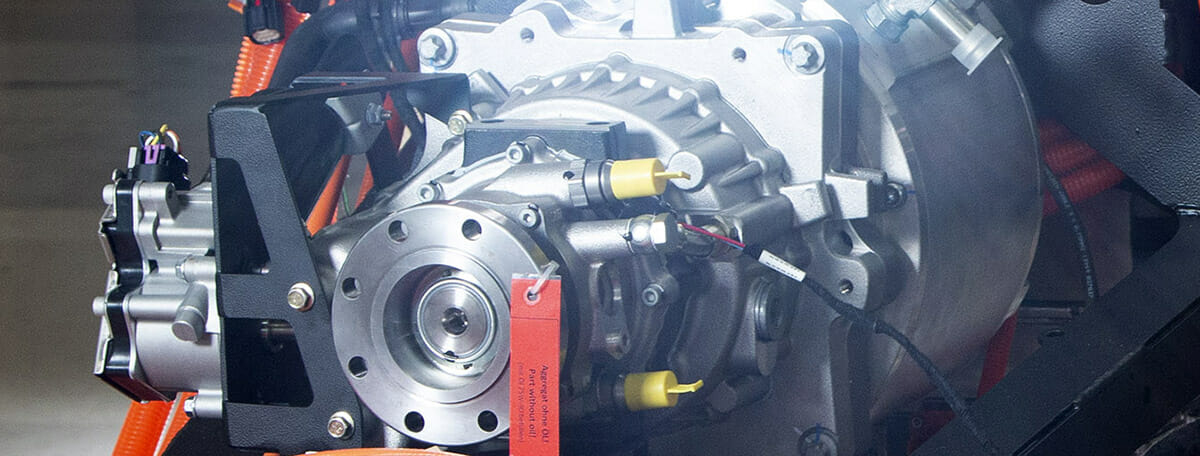

The Truth About Reliability: Check Out the Components!

Commercial fleets live and die on vehicle reliability. Every hour a vehicle isn’t running is an hour it isn’t making revenue. As commercial fleets transition to battery electric vehicles (BEV), reliability and serviceability must be considered. To date, though, this subject has been glossed over, largely because there is very little real-world reliability and serviceability data available to draw conclusions from. Further, many manufacturers have simply made grandiose statements promoting the fact that there are fewer moving parts – so therefore it must be more reliable, surely?

However, there may be a better way to understand and predict reliability than just relying on broad statements: Examine the development and quality history of individual components.

It is important to note that there are three commercial BEV markets worldwide—China, Europe, and the USA. Although China has the vast majority of BEVs on the road in the world today, it is also widely known that most vehicles on the road in China are built for 1 to 3 years of duty. They are highly government subsidized, and the subsidies are focused towards different vehicles every year. Therefore, the quality of Chinese components is typically well short of US and European expectations, where commercial vehicles are expected to last 7-25 years. This has already begun to play out in several US fleet deployments of Chinese-built commercial vehicles, as they have seen many issues with quality and performance, often within the first 18 months (a basic Google search will reveal several public stories).

The highest quality components are typically made outside of China (US, Europe, Japan, Taiwan, South Korea). For example, the highest quality battery cells come from South Korea today (Samsung, LG Chem, and Panasonic). This can be validated when looking at the leading US Automotive manufacturers choices of components: GM uses LG batteries, Tesla uses Panasonic, Jaguar uses LG, etc.

To make this point, take a look at a table of components from Lightning Systems and its major competitors in the US market:

| Component / system | Lightning Systems component origin | Competitor component origin | Lightning Systems key quality attribute | Competitor key quality attribute | Lightning Systems spare part availability | Competitor spare part availability |

|---|---|---|---|---|---|---|

| Battery system | South Korea | China | Actively thermally managed, with sub-ambient cooling | None | In stock in CA, Detroit and CO | China: 8-26 weeks |

| Traction motor | US | China | Validated by millions of miles on US roads with thousands of automotive and bus customers | None | In stock in Colorado | China: 8-26 weeks |

| Electric heating system | Germany | China | Validated by millions of miles on US roads with Ford customers | None | In stock at Ford dealers | China: 8-26 weeks |

| Electric air conditioning | Japan | China | Validated by millions of miles on US roads with Mitsubishi customers | None | In stock at Mitsubishi dealers | China: 8-26 weeks |

| Power steering | US | China | Validated by millions of miles on US roads with Jeep | None | In stock at Chrysler dealers | China: 8-26 weeks |

| Air brake compressor | Japan | China | Validated by millions of miles on US roads with Isuzu | None | In stock at Isuzu and GM dealers | China: 8-26 weeks |

| On-board vehicle charging system | Taiwan | China | Uses Standard CCS-1 combo charging | Uses proprietary charging system/plug | In stock in Loveland, CO | China: 8-26 weeks |

Why would a commercial EV vendor choose non-validated Chinese-made components for mission critical applications? Clearly even an air brake failure will render the vehicle down for an extended period of time, especially given the current import and tariff challenges around Chinese components. The answer is cost. Several industry OEMs have decided that the price must be equal to or less than current subsidies in California, so they have placed a price target that diminishes quality — and their customers end up bearing the brunt of this choice. The lower up-front cost will be accompanied by very expensive down time. Initial deployments by two leading Chinese electric commercial vehicle importers are already demonstrating this fact.

So what’s the bottom line? Ask your electric vehicle manufacturer where they get their key components from, how much US road service they have seen (not just in that vendor’s BEVs) and how available replacement parts are.

Download this article as a PDF document.

Sign up to download our informative free guide, Electric Commercial Vehicles: What To Look For

Sign up to download our informative free guide, Electric Commercial Vehicles: What To Look For